On December 2, Gear Energy ($GXE.TO) announced that it was being acquired by a large, publicly traded company, excluding certain properties in Central Alberta, Southeast Saskatchewan and Tucker Lake, which would be transferred to a newly formed company (Newco). Holders of Gear Energy stock could elect to receive either $0.607 CAD in cash, 0.3035 common shares of Newco, or a combination of both. Importantly, there was only $80mm in cash and 40mm in shares, so for those who elected to receive 100% in cash, you could still end up with shares if there was not enough cash for all of the investors who chose the 100% cash option.

From the outside, this looked like a friendly transaction. Gear recommended that shareholders should vote for the acquisition, and there was no chance of the deal not going through. Despite this, $GXE.TO shares traded for ~$0.50 CAD since the announcement and have stayed there throughout the process, presumably due to concerns that the shares would not be as valuable as the $2 recommended by the Board.

Ultimately, I decided to play this acquisition, and I wanted to lay out my thought process.

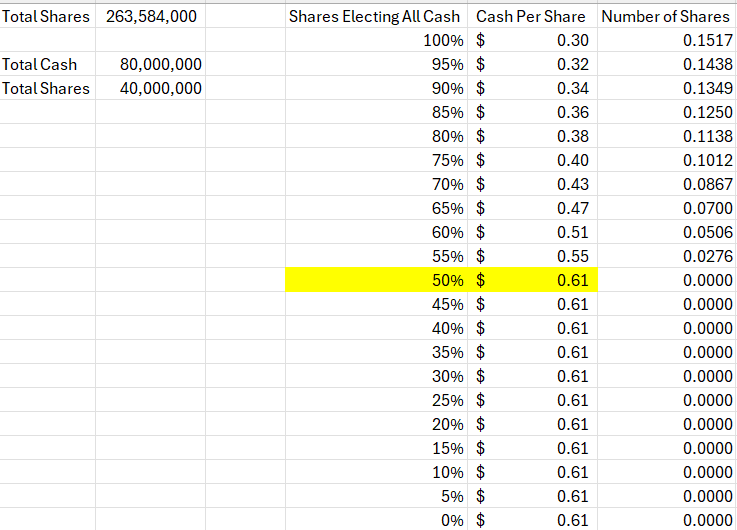

Above is a table representing the potential outcomes of how much cash each shareholder gets compared to common stock, based off of the percentage of shares that elect for a full cash payment. Per terms of the merger, cash per share is capped at $0.607 and shares of Newco to 0.3035. You can see that if 50% of shareholders elect all cash, they would get the full cash payment, and that decreases all the way down to ~$0.30 if all shareholders elect cash.

It felt unlikely to me however that just 50% would choose all cash. I felt that despite the friendly feelings of the merger, roughly 75-85% of shareholders would choose the full cash allotment, meaning that they would get roughly $0.40 in cash and the remaining amount in stock.

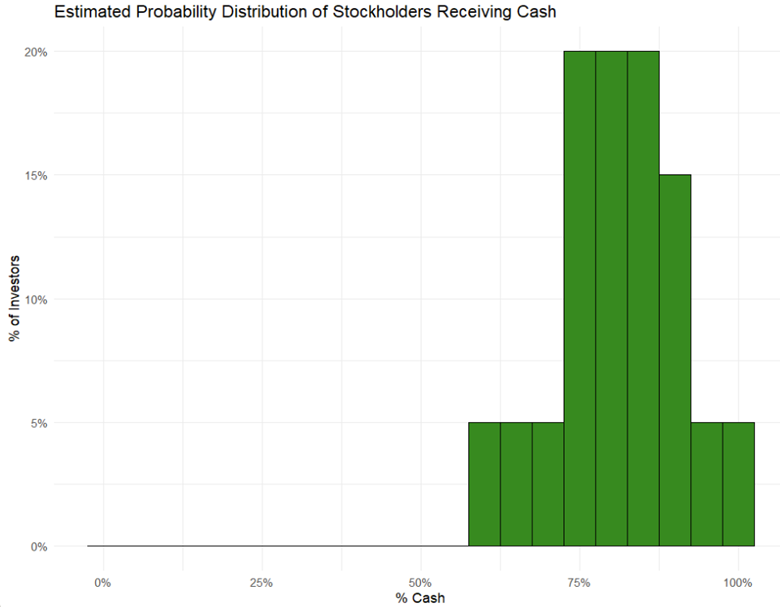

To get fair value for the stock, I needed to come up with a probability distribution that represents the percentage of the investor pool electing to receive full cash. From the Interactive Broker statements, it looked that 10% of the company was held by insiders. Given the friendly nature of the takeover and the fact that they were still a part of the new company, I doubted that they would take the full cash. I ended up assigning 15% probability the 60%-75% cash interval, 10% to the 95-100% interval, 15% to 90%, and then 60% to the 75-85% interval. The distribution is represented below.

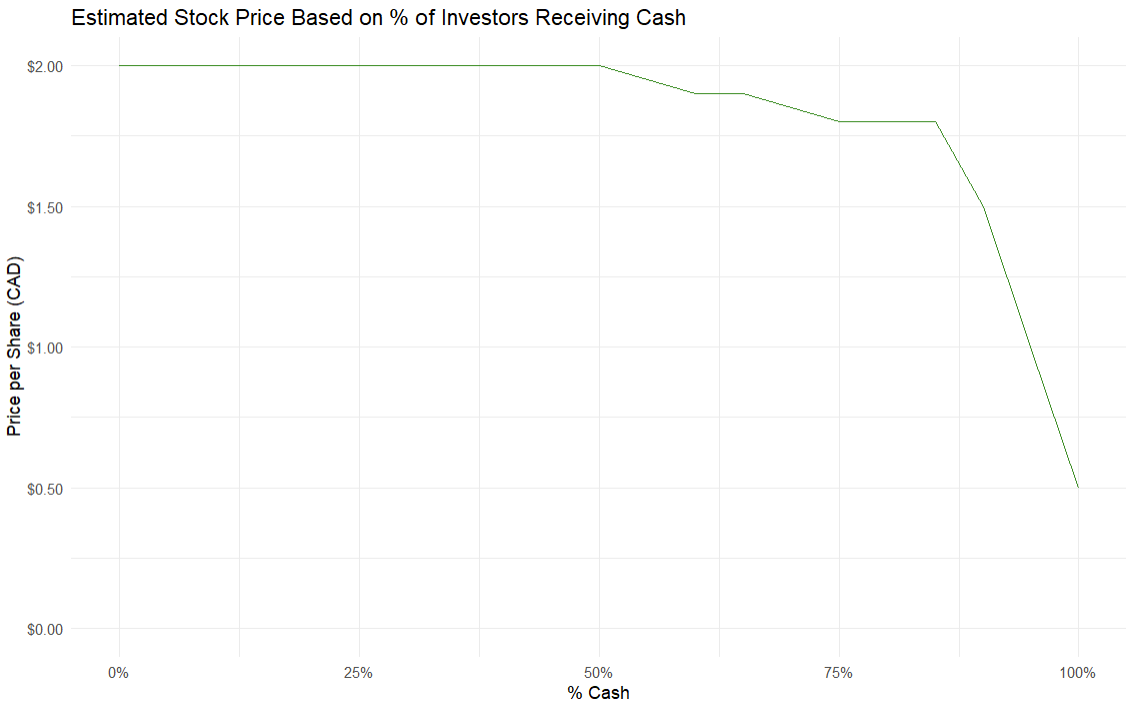

Lastly, I needed a distribution of what I thought the stock would trade at. Materials were presented to let you decide what the fair value of the stock is based off of the fundamentals, but I wanted to take a less fundamental, more “market-based” approach. The company is valuing shares of Newco at $2.00 per share. However, if 100% of investors in the company elected cash, it’s unlikely that the market would price the new company at $2.00. I came up with a rough distribution of expected Newco stock price based on percentage of investors electing cash below. If 100% chose cash, I thought the Newco stock would be around $0.50, and go up steeply from there, approaching $2.00.

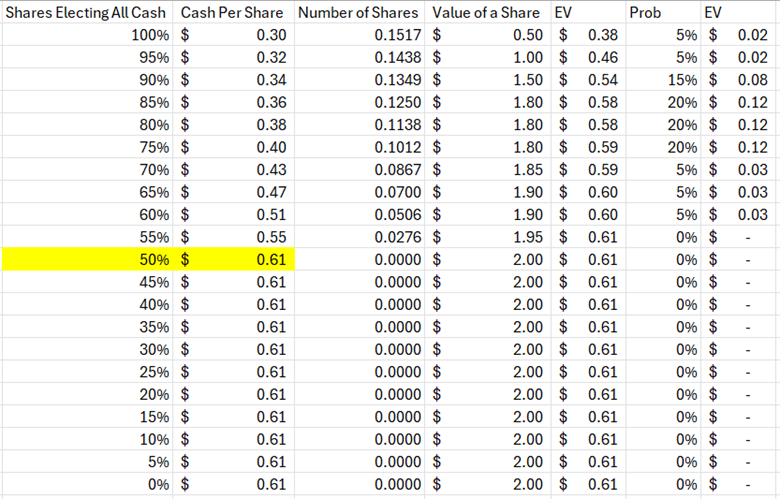

Here’s the full summary:

Based on these assumptions, the expected value of the stock is $0.56. I purchased shares at $0.50, expecting a 13% return in the two weeks. The worst-case scenario here would have been 100% of the stockholders electing for cash, which had an expected value of $0.38, representing a 24% loss. I felt that the asymmetry of the trade was reasonable, and that Gear Energy represented a solid opportunity.

On February 5, it was announced that shareholders who elected to receive all cash will receive $0.449 in cash, along with 0.079 shares of Newco. By my math, that means roughly 67% of investors elected for all cash, better than my original 75-85% assessment. I’m expecting the new stock to trade for roughly $1.85, making the final amount worth ~$0.595, good for a 19% ROI.

Update (2/12/25): The Newco shares (Lotus Creek LTC), ended up trading for $1.30-$1.40 in the first few hours of trading, significantly worse than the $1.85. I was able to exit the position at $1.30, good for ~$0.55 per share of GXE, or a 10.30% ROI. Obviously, it’s not good to be this far off in my assessment of where the stock would trade at. However, a 10.30% ROI in 13 trading days is an excellent return for taking on minimual risk, and this is a trade I would repeat again.